Urgent Call for Spot Bitcoin ETF Approval

Spot Bitcoin ETF approval is the focal point of a bipartisan initiative, as two influential members from the House Financial Services Committee come together. Addressing SEC Chairman Gary Gensler, their letter emphasizes the need for prompt action to facilitate the launch of exchange-traded funds (ETFs) linked to Bitcoin.

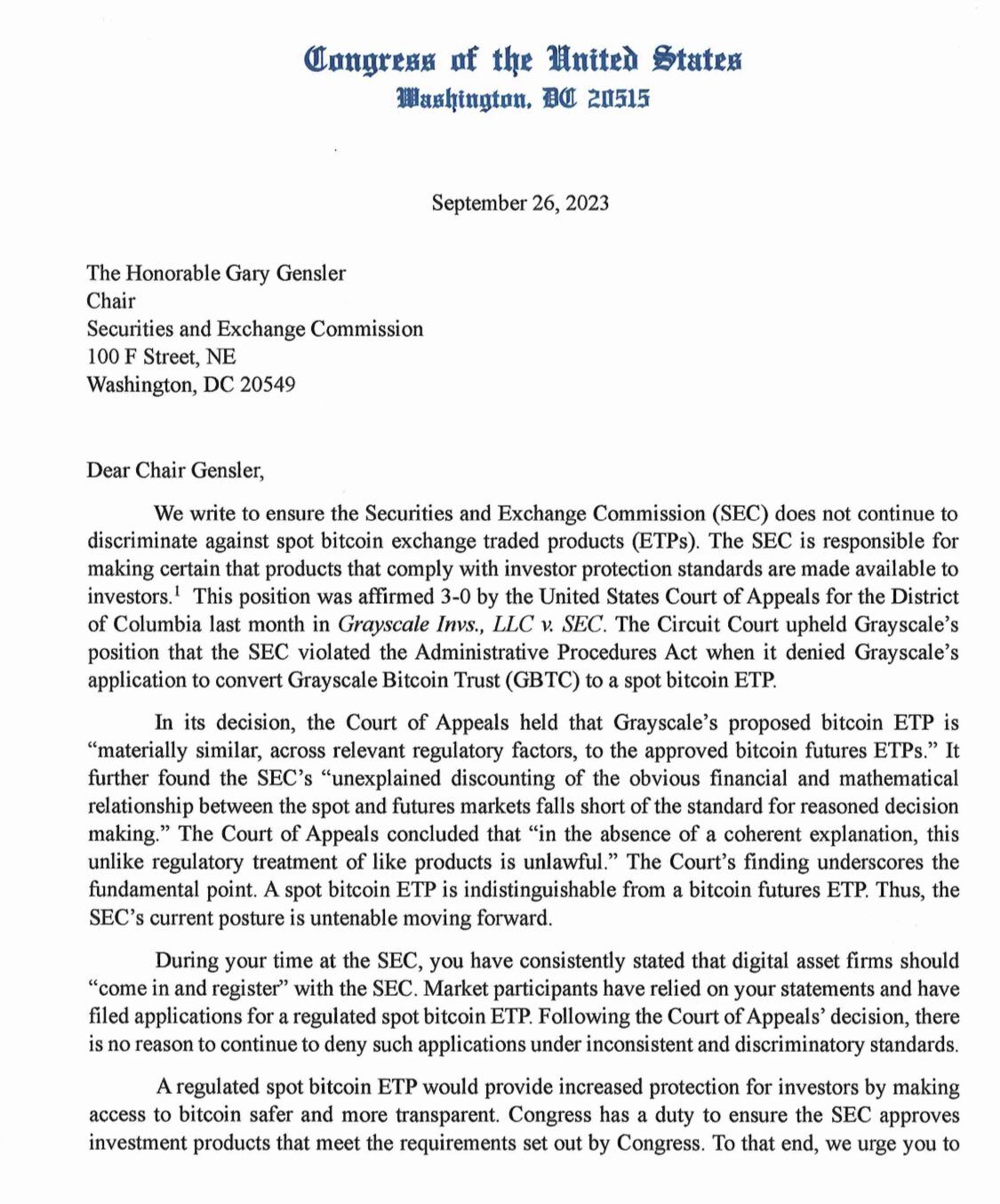

A bipartisan group of four U.S. Congressional Representatives is pressuring SEC Chair Gary Gensler to promptly approve spot Bitcoin exchange-traded funds (ETFs).

In anticipation of Gensler’s appearance before the House Financial Services Committee, the four committee members have written a letter to Gensler arguing that spot Bitcoin ETFs closely resemble crypto futures ETFs, which the SEC has already approved. They contend that the SEC should, therefore, grant approval to applications from entities such as Fidelity, BlackRock’s iShares, and Grayscale Investments, affiliated with CoinDesk’s parent company, Digital Currency Group.

The signed letter, endorsed by Representatives Mike Flood (R-Neb.), Tom Emmer (R-Minn.), Wiley Nickel (D-N.C.), and Ritchie Torres (D-N.Y.), emphasizes that the SEC’s current stance is untenable. They argue that, following a Court of Appeals decision, there is no valid reason for rejecting these applications based on inconsistent and discriminatory standards.

“Following the Court of Appeals’ decision, there is no reason to continue to deny such applications under inconsistent and discriminatory standards.”

“A regulated spot bitcoin ETP would provide increased protection for investors by making access to bitcoin safer and more transparent,” stated the letter. “Congress has a duty to ensure the SEC approves investment products that meet the requirements set out by Congress.”

The request anticipates Gensler’s testimony before the House Financial Services Committee, where the SEC’s oversight will be under discussion. All four legislators are committee members and may raise this issue during the hearing scheduled for September 27th. It’s noteworthy that the proceedings are unlikely to be impacted by the imminent threat of a government shutdown, as lawmakers have yet to reach a spending agreement at the time of this statement.

As of now, the SEC has not granted approval for any spot Bitcoin ETFs. Many had anticipated that the SEC would reconsider pending ETF applications following its legal loss to Grayscale in August. However, the regulator subsequently postponed decisions on ETFs from seven major firms, including BlackRock, WisdomTree, Invesco Galaxy, Valkyrie, Bitwise, VanEck, and Fidelity.