TEZOS STAKING ON COINBASE PRO

Coinbase Pro has announced Tezos staking for all holders on Coinbase, meaning all eligible customers in the US can receive staking credits.

Why? -> Coinbase is focused on offering customers a simple way to grow wealth in the space

How? -> Offering staking rewards on Coinbase for all customers (including USA)

What? -> ROI currently approximately 5%, this will accrue in real time on the app. After the first 35-40 days (the stake maturity period) the first payout will take place and then every three days after.

INTRODUCING CBDC

First it was “Blockchain”, then it was “ICO” and “stable coin” and now it’s “CBDC” – an acronym we all better get used to;

CBDC = Central Bank Digital Currency

With the Peoples’ Republic of China announcing their intention to launch digital currency Renminbi, they’re likely to be beaten to market by Tunisia. “The E-dinar was officially launched in test form at the Forex Club of Tunisia, with a symbolic transfer of one dinar between the head of the central bank, Marouane El Abassi and a representative of the International Monetary Fund (IMF)”, reported Ledger Insights.

This would make it the first ever live CBDC. The cryptocurrency Venezuelan Petro is excluded from this definition as it doesn’t inherently represent capital being converted to electronic form, something Tunisia has achieved.

Universa Blockchain CEO Alexander Borodich discussed key distinctions for a CBDC with Ledger Insights;

“Electronic banknotes cannot be faked – each such banknote, like the paper version, is protected by cryptography, it, like the paper counterpart, has its own digital watermarks. And the production of such a banknote is 100 times cheaper than wasting ink, paper, electricity for the printing press.”

This week alone:

- Turkey announced its CDBC, the crypto Lira or digital Lira, is scheduled for launch next year.

- Hong Kong announced their research into a CDBC which will be in collaboration with the Peoples’ Republic of China.

- Binance announced it will be advising the Ukraine Government on upcoming crypto regulation and assisting in digitizing the country’s finances

And Universa claims “Tunisia could soon be followed by Malaysia, the Philippines, Argentina, Brazil, and China in CBDC issuance. Indeed, a Chinese foreign exchange official, and many others, thought his country would be the first. Plus Singapore, Thailand, and Canada have made strides in digital currency research.”

EU TO REGULATE STABLECOINS

The EU has drafted a response to the Libra project this week which leaves the door open to “assess the costs and benefits of central bank digital currencies.” The response elaborates to say “…(they are) taking a closer look at how to regulate stablecoins, but has no plans to issue one of its own.”

“The statement is to highlight the need for a proper regulatory framework for those stablecoins and as a consequence, different ideas should be explored. One of them is the possibility of having something that is managed by the ECB [European Central Bank] and other central banks.”

Interesting insight into the EU’s thoughts on not yet wanting to pursue a CBDC but welcoming stablecoins. There seems to be an understanding of the reality of where the world is moving, and want to be part of it with a legislated approach and adoption.

We are almost seeing three global approaches:

- China, Russia and surrounding Balkan countries seeking CBDC, blockchain and cryptocurrency technology, under strictly regulated frameworks.

- USA extremely hesitant to allow any stablecoin technology such as Libra. Anti-CBDC due to belief that it would weaken the USD.

- Europe not yet interested in CBDC but believing the stablecoin space is inevitable. Will create a regulated framework to ensure control of its growth.

This is a large shift from several years back when cryptocurrencies and blockchain technologies were being slammed as scams and a bubble. Crypto is here to stay.

SQUARE REPORTS DOUBLING IN FIRST TIME BTC BUYERS

Square, a payment company founded by Twitter co-founder Jack Dorsey, has released their Q3 earnings. The report flagged the amount of first-time bitcoin buyers has practically doubled.

As outlined by Coindesk, some key numbers from the report;

- Square’s bitcoin revenue represents a 244 percent increase year-on-year

- Generated $43 million in revenue during the third quarter of 2018

- $146 million in bitcoin costs this past quarter

- A profit of only $2 million on bitcoin sales for the second quarter in a row

- Cash App as a whole clocked $307 million in revenue in Q3

- Q4 guidance, Square predicts that bitcoin and transaction costs will range from $575 million to $585 million.

Square has also released a new fee structure for users which removes the spread fee (difference between BTC market price and their buy/sell price) and has introduced a fixed fee per transaction. It’s still unknown if this will pass on significant costs to buyers or not.

BITCOIN TECHNICAL ANALYSIS

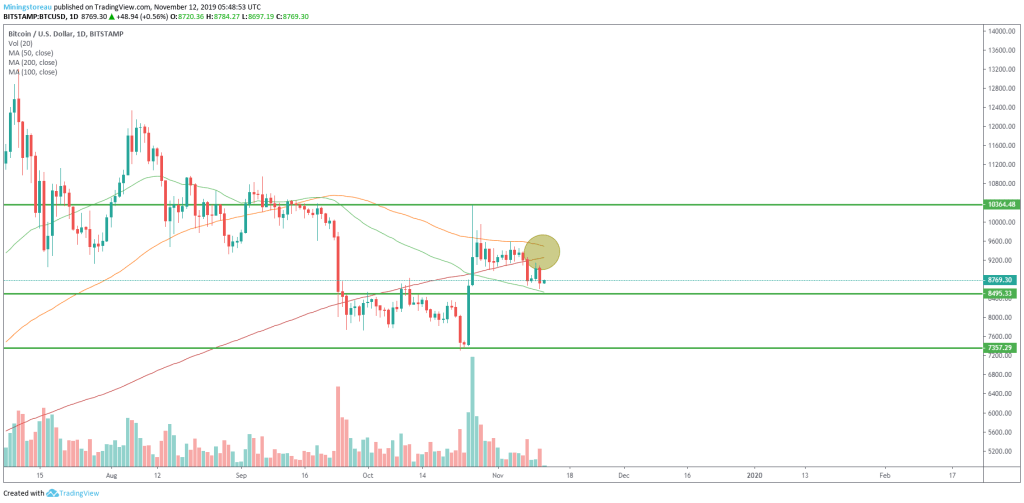

This week the bears took over the market and successfully pushed BTC down sub 9k USD again. Within 24 hours BTC returned back to 9k territory only to be hammered straight back down again.

We are still trading in a potential bullish channel between 8.4k-10k USD, however, an imposing death cross with the 100/200 MA lines is approaching. The death cross is highlighted in the yellow circle in the image above.

Bulls will need to fight hard this week to push BTC above 9k again and keep the bullish price action in play. If the bulls fail to defend the 8.4k support line then we will enter the lower channel between 7.3k and 8.4k. From here a death cross could cause some new monthly lows to be tested.

US CONCERNED RE CRYPTO SECURITY

At a recent US Senate Committee hearing on Homeland Security and Government Affairs, US Senator Mitt Romney voiced concerns that cryptocurrency in America could threaten Homeland security.

Senator Romney admitted to not being up to speed with the ins and outs of crypto;

“I’m not in the Banking Committee. I don’t begin to understand how cryptocurrency works. I would think it is more difficult to carry out your work when we can’t follow the money because the money is hidden from us and wonder whether there should not be some kind of effort taken in our nation to deal with cryptocurrency.”

FBI Director Christopher Wray responded:

“Well certainly for us cryptocurrency is already a significant issue and we can project out pretty easily that it’s going to become a bigger and bigger one. Whether or not that is the subject of some kind of regulation as the response is harder for me to speak to.”

This all comes around the time Libra is trying to work its way through Congress and Senate hearings. And there is speculation that if the USA really wanted to, they could pass bills and legislation that simply outlawed Bitcoin. In theory it could still work on regulated exchanges, but in the long run the pure decentralised way it operates means this is impossible. And like anything outlawed, could actually fuel more interest.

Further reading here and here.

BAKKT SETS MORE RECORD HIGHS

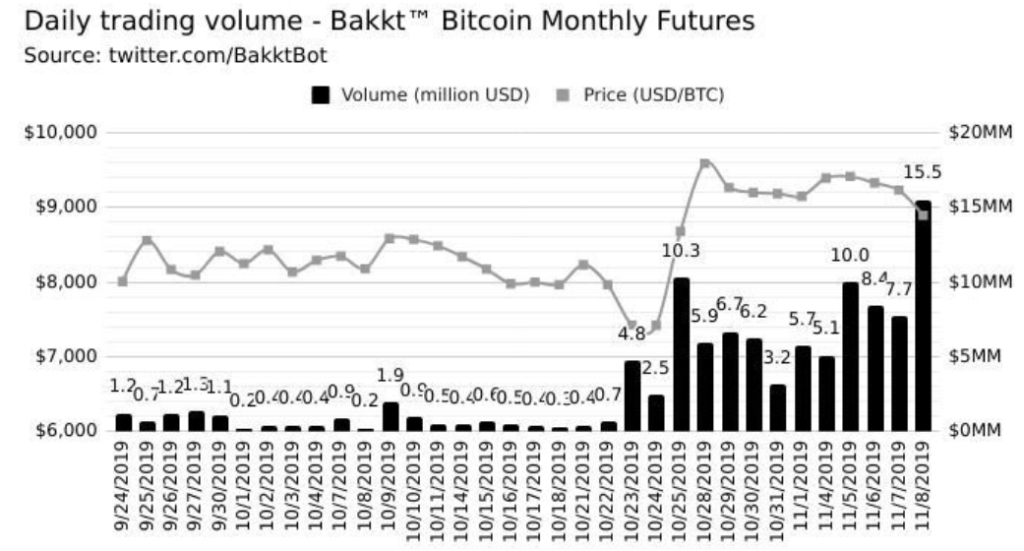

Bakkt set a new record volume by reaching 1741 on Nov 8th. The below image from the Bakkt Twitter Bot shows just how quickly the volume is picking up.

The current daily mined Bitcoin is 1800. With the halving in May 2020, this will drop to a mere 900. Consider that Bakkt’s current volume alone is almost all of the new Bitcoin generated daily from mining. Couple this with the enormous demand Greyscale has been eating up each month and demand outstripping supply like this leads to one inevitable outcome, price appreciation.

I’ll leave you with this quote from NewsBTC re institutional longs:

“Skew Markets found that institutional longs on the Chicago Mercantile Exchange’s Bitcoin futures market has hit a one-month high, reaching around 1,300 BTC worth of contracts. This is up by over five times from the bottom near 250 BTC seen in late-September.”

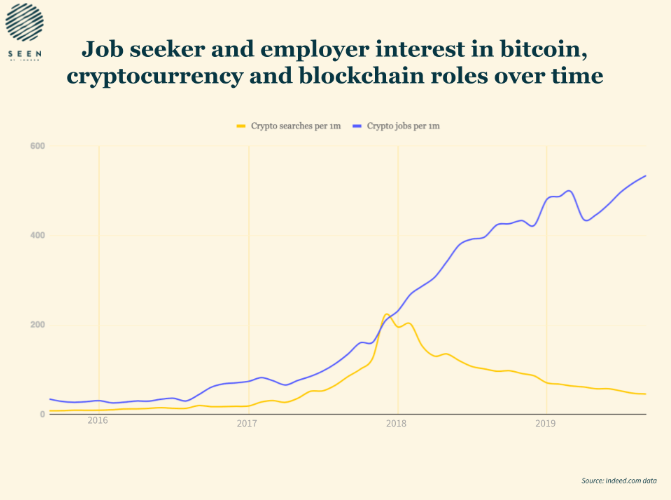

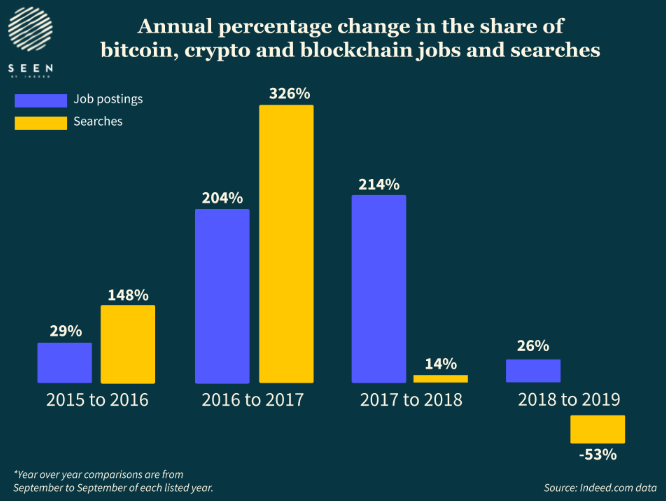

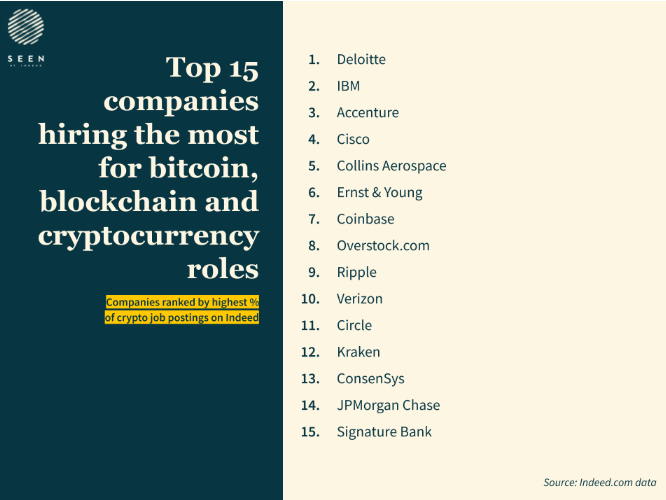

JOBS INCREASING IN CRYPTO SPACE

Be Seen by Indeed has released research on job advertising, search and employers for the crypto space. It’s a solid read, and worth checking out. There was a 26 percent increase in job ads for the crypto space in the 2018-19 measurement period.

The below image depicts “the four-year period between September 2015 and September 2019, the share of these jobs per million grew by 1,457%. In that same time period, the share of searches per million increased by ‘only’ 469%.”

Quite clearly dropping off after the Bitcoin price started dropping in 2018.

Unfortunately, the hangover from the 2018 ATH of Bitcoin from $20K has seen job searches dropping off dramatically but interestingly, job postings still showing gains year on year.

The top 15 employers looking for and placing jobs in the space were:

RUSSIA TO CONFISCATE BITCOIN?

Russia is trying to achieve the impossible, confiscate Bitcoin. Russia’s most recent statements on digital assets has it positioning to introduce new laws that would allow it to “confiscate” “digital assets” they are also considering a government backed cryptocurrency wallet where citizens would need to hold their assets… There is an old adage in the crypto space, not your keys, not your crypto?! Effectively, why would you ever want to hold your digital assets in a wallet controlled by the government? In short, you wouldn’t.

Nikita Kulikov, who heads up the dedicated Russian Committee on digital assets, told Cointelegraph:

“The constant growth trend in crimes using virtual assets, and the lack of consumer protection in the face of this kind of criminal onslaught, naturally dictate the need to develop mechanisms for legal regulation and control of virtual asset exchange.”

CHINA TO ALLOW CRYPTO MINING

Chinese authorities appear to have eased up on Crypto mining bans. New official documents referenced by Cointelegraph and others no longer feature Crypto mining as an ‘undesirable’ industry by Beijing. If this is truly the case and mining within China becomes legal, it would be bullish for the future of Bitcoin and cryptocurrencies.

COCA-COLA USES BLOCKCHAIN

Coca-Cola has implemented Blockchain technology to manage cross party transactions, citing,

“There are a number of transactions that are cross-companies and multiparty that are inefficient. They go through intermediaries; they are very slow. And we felt that we could improve this and save some money.”

Blockchain technology would be used for 160,000 orders per day, and they expect to reduce the reconciliation time for all orders down from 50 days to only a couple. The ledger that currently generates $21 billion per year in revenue will be switched over to an inter-organisational, transparent distributed ledger.

Other big businesses getting into the space include IBM, Walmart and Starbucks. If you wanted to have a look at a cryptocurrency that works in this space VeChain is a recent project that has attracted a lot of attention.

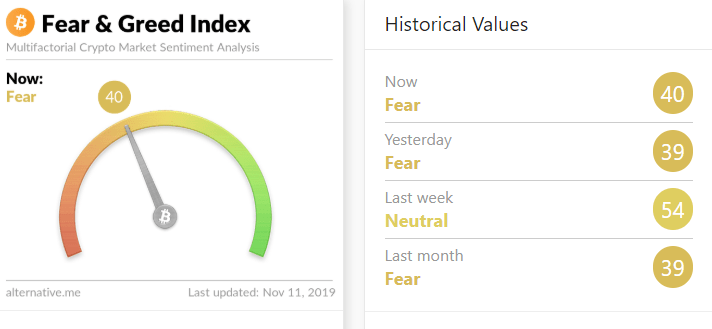

FEAR, GREED AND MENTALITY

Alternative.me Fear and Greed index has wound back to 40 and slight fear this week. I get the feeling we are trading at major lows around this $8,500-$9,000 mark and the market is getting ready for that next move north. As always, do your own research. And to paraphrase the great Warren Buffett, buy when people are fearful and sell when people are greedy.

Author: Julian Carruthers

Read last week’s weekly summary here

Not financial or investment advice, always do your own research.