What is Voyager?

Voyager is a “fast-growing, publicly traded cryptocurrency platform in the United States founded in 2018 to bring choice, transparency, and cost efficiency to the marketplace. Voyager offers a secure way to trade over 100 different crypto assets using its easy-to-use mobile application, and earn rewards up to 12 percent annually on more than 40 cryptocurrencies. Through its subsidiary Coinify ApS, Voyager provides crypto payment solutions for both consumers and merchants around the globe”.

Per Voyagers whitepaper, Voyager Digital Ltd. and its subsidiaries (collectively, “Voyager”) have developed a market-leading, crypto-asset platform (“Platform”) that provides retail and institutional customers with a robust, yet simple solution to trade, invest in and earn yield rewards for maintaining a minimum balance in certain crypto assets (“Yield Rewards”).

Voyager offers high-quality execution and safe custody on a wide variety of popular crypto assets. Voyager was founded by established Wall Street and Silicon Valley entrepreneurs to create more choice, transparency, and a cost-efficient alternative for trading crypto assets.

Per Coindesk, upon its summit, Voyager actually boasted around 3.5 million users and $5.9 billion in assets, comparable to a small regional bank or respectable wealth management firm.

Ninety-seven percent of Voyager’s clients stored less than $10,000 on the platform, indicating a broad base of individual investors. It was a cryptocurrency lending and trading powerhouse, one of the few digital asset brokerages listed on stock markets anywhere in the world (albeit in Canada rather than the U.S., its home country).

Voyager’s future for the most part was seemingly bright, until recently. Clearly, Voyager’s seemed barely able to conceive of a bear market, much less its consequences. Speaking in 2021, CEO Steve Ehrlich said that “I think the market looks completely different today from what it looked like in 2017. We all remember 2017.”

On July 5, Voyager Digital filed for Chapter 11 bankruptcy in the Southern District of New York. This type of bankruptcy enables the company to stay operational while executing a recovery plan.

This was as a result of overleveraging and clearly not being equipped to withstand the brutal cryptocurrency crash off the back of an insane boom that occurred in 2021.

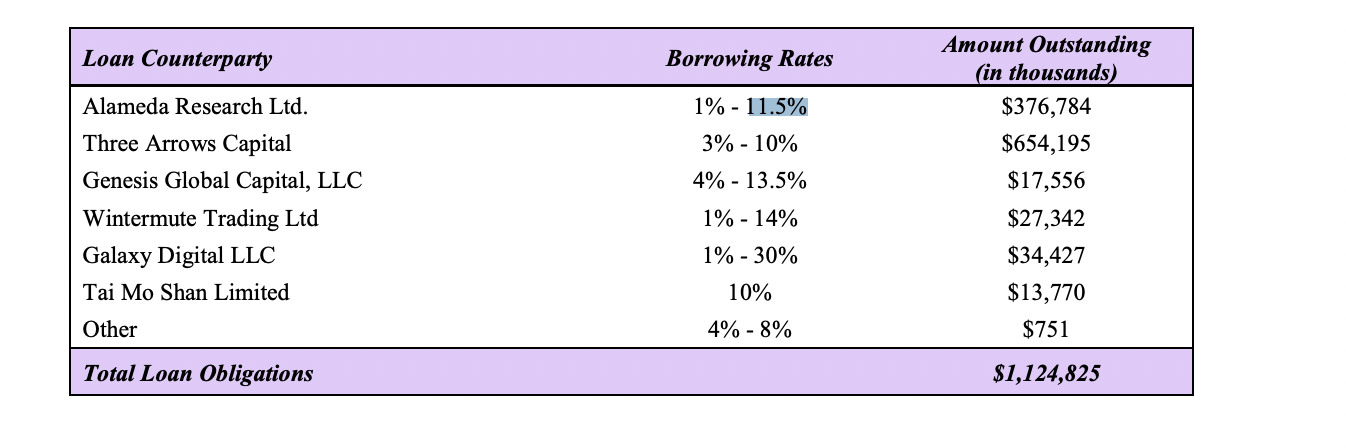

It turns out that Voyager indeed had an immense unsecured loan to Three Arrows Capital (3AC), a hedge fund that has now seemingly defaulted on all of its loans. This alone was enough for Voyager, on July 1, to freeze all customer funds, just days later filing for the bankruptcy mentioned above.

This created its current dire situation. “The Debtors are facing a short-term ‘run on the bank,’” according to a statement Ehrlich filed alongside bankruptcy papers. However, according to Ehrlich, Voyager still has light ahead, stating “debtors have a viable business and a plan for the future.” (Under Chapter 11, the company is seeking to reorganise rather than liquidate).

So where did it all go wrong?

Way too much exposure to a weave of debt and leverage.

Firstly, the collapse of the Terra blockchain ecosystem and its TerraUST stablecoin, UST and the ensuing contagion certainly played a role. Voyager claims that it was not directly exposed to the stablecoin or LUNA token, however, was exposed to business partners that were.

This is where 3AC comes in. 3AC, a widely respected Singapore-based hedge fund with loans across the industry and bets across the space, “was in jeopardy” of failing to pay up. Its own “massive” bets on LUNA had imploded into a black hole of losses.

3AC was also underwater on positions in Lido staked ether (stETH) and the Grayscale Bitcoin Trust. (Grayscale is owned by Digital Currency Group, which also owns CoinDesk). Notably, Ehrlich does not mention either of these in his bankruptcy narrative, possibly reflecting a troubling lack of insight into the operations of a company to which he offered a $650 million unsecured loan.

Either way, Three Arrows was down bad across the board. It was also one of Voyager’s single largest lending customers.

This is essentially at the core of Voyager’s downfall. It was essentially a cryptocurrency bank, using deposited cryptocurrency, and then engaging in very risky lending.

Per Coindesk, Voyager is one of several retail-facing crypto institutions that generate interest on deposits by loaning crypto assets out to traders and institutions. Investment firms and hedge funds like Three Arrows Capital rely on these loans to make big trades. They take in capital from lenders, long or short a cornucopia of (risky) assets, invest in early-stage companies – and if all goes well, earn massive returns relatively quickly.

Some of these returns funnel back to their lending partners as interest payments. In turn, those partners, lenders like Voyager, pass a slice of the interest to customers. The process creating that chain of events that led to these yield payments is almost irrelevant – and certainly not transparent – to depositors. All they see is a nice pay out in their accounts.

Until, that is, something goes wrong.

As Danny Nelson and David Morris note, when asset prices tumble or a counterparty defaults on a massive loan, the lenders are left with gaping holes in their balance sheets. The systemic downturn has blown up not just Voyager but also Celsius and Babel Finance, all of which have frozen withdrawals and most of which now appear insolvent.

That has had real ramifications for real people, many of whom came to Voyager and its ilk with modest savings, in search of higher yield. What they may be realising too late is that these crypto lenders are not the same as banks, and it’s unclear exactly how or if their deposits will be recovered. Voyager, for its part, is now under regulatory scrutiny for allegedly misrepresenting insurance on customer deposits.

Among crypto lenders, Voyager is also notable because it’s the first to take the bankruptcy route. As part of that process, Ehrlich has filed a lengthy statement detailing the company’s challenges. It provides an unvarnished glimpse into the same shaky foundations of all the crypto lenders.

How has it ended?

Its gesture of trust in 3AC we’ve learned was woefully misplaced, as it was such a large loan that required no capital. It spelt a very ugly ending.

With the lending business hitting its stride during the pandemic, benefiting from low interest rates and exponentially increasing enthusiasm for cryptocurrency as an asset class, Voyager was ballooning in popularity.

However, in 2022, the war in Ukraine, rising inflation and rate hikes from the U.S. Federal Reserve further shook crypto’s up-only drumbeat. Between November of 2021 and April of 2022, crypto asset prices slumped by roughly 33% across the board.

As Nelson and Morris write, then the wild card reared up. Starting in early May, the UST stablecoin began a “death spiral” that wiped billions of dollars in wealth from the global crypto economy. Within days, a blockchain that Ehrlich claims was “widely viewed as a project with significant promise” and had major backing from investors of all stripes, had gone all but kaput.

Meanwhile, two less dramatic but similarly threatening sinkholes were opening. Starting in early 2021, the Greyscale Bitcoin Trust began trading at a significant discount to the underlying bitcoins. And stETH, effectively a promissory note for ETH on the upcoming Ethereum 2.0 system, began trading at a discount to ETH. Both of these developments meant investors had to take big losses if they wanted to turn positions in those assets into ready cash.

One big holder of both GBTC and stETH was, you guessed it, Three Arrows Capital. 3AC’s loss of its entire $200 million initial stake in LUNA might not have been fatal if it hadn’t already been underwater on those other positions. But in any event, Three Arrows, for years one of the most respected trading firms in crypto, did the unthinkable: It simply disappeared.

Voyager had previously loaned $350 million in the stablecoin USDC and 15,250 bitcoins to Three Arrows. As the market continued to slide, Voyager made multiple demands for repayment in late June. But Three Arrows did not respond and was also ghosting other partners. $650 million of Voyager funds, effectively including a lot of customer deposits, was simply gone.

The dominoes were falling. Terra’s downfall led to Three Arrows’ default led to Voyager’s reckoning.

This wasn’t some normal crypto winter.

Contagion season had arrived.

To stop the bleeding, Voyager in mid-June brokered a nearly $500 million loan facility with Alameda intended to support the company’s short-term finances. It was at best a Band-Aid, a “partial solution” to contagion-fueled liquidity issues exacerbated by the greater crypto market rout.

Making matters worse, Celsius, another crypto lending giant, was falling apart at the same time. Celsius froze customer withdrawals on June 12, shaking broader confidence in lenders and the markets and prompting Voyager’s own clients to run for safety. Lowering daily withdrawal limits from $25,000 to $10,000 per day on June 23 was meant to stop the race to the exit and buy Voyager time.

But it wasn’t enough in the face of what Ehrlich describes as “an influx of customer withdrawals” that threatened “the Company’s ability to serve customers who remained on its platform.” As the market continued to fall, Voyager’s situation grew ever dire. On July 1, it froze all customer withdrawals and trading to “avoid irreparable damage to the Debtors’ business and ensure that its trading platform operated smoothly for all customers.” (Not being able to withdraw, it must be noted, seems in itself like less than smooth operation.)

Voyager went into what might be described as panic mode. By mid-June, it retained legal counsel; a consultancy joined the fray by month’s close. The Canada-listed public company needed “potential strategic solutions” to its looming liquidity crisis – and it needed them fast. That could include selling businesses or raising capital.

Some temporary breathing room came in the form of a June 20 unsecured loan facility worth roughly $500 million from trading powerhouse Alameda Research. Alameda founder Sam Bankman-Fried (also the CEO of the FTX exchange) has become crypto’s backstopper-in-chief during the market rout. Voyager initially borrowed $75 million, to be (theoretically) paid back by late 2024.

Meanwhile, the investment bankers reached out to “60 potential financial and strategic partners” – that is, potential saviours – according to Ehrlich. They got 22 leads toward a rescue deal, but only one proposal emerged. The offer was too much of a lowball for Voyager to stomach. No other options appeared.

“It became clear that a potential strategic transaction would only emerge after the Company petitioned for chapter 11 relief,” Ehrlich states.

Voyager tells the court it plans to mount a comeback. A Chapter 11 restructuring would allow Voyager to shed debt and restructure itself, rather than having to liquidate its assets. “Voyager will move as swiftly as possible through these cases to maximise the value of its business and allow customers to fully use the Company’s platform,” Ehrlich writes. A “robust marketing process” is already underway to signal Voyager cannot be counted out.

That marketing effort will need to be very robust indeed, since both broader conditions and some of Voyager’s own actions have profoundly undermined whatever public trust it enjoyed. A restructuring plan announced Monday would compensate users for missing crypto with shares of Voyager equity and Voyager tokens (whatever those are).

That’s unlikely to leave users particularly happy, though it might give them a backdoor incentive to continue using the crippled service.

Is it all doom and gloom?

In an update, the company said users will get their funds back, “subject to a reconciliation and fraud prevention process.”

“Customer cash belongs to you and will go back to you, subject to a reconciliation and fraud prevention process. All customer cash is held in a customer account at Metropolitan Commercial Bank and is equal to the amount of cash in Voyager accounts.“

It also included that the USD cash equivalent of customers’ funds is held with Metropolitan Commercial Bank in a “For Benefit of Customers” (FBO) account.

Voyager Digital further disclosed that cryptocurrency-assets come in at roughly $1.3 billion, plus a $650 million debt owed by Three Arrows Capital (3AC).

Voyager Digital said it’s working as quickly as possible to open user account access in an update posted on July 11.

According to Voyager Digital’s update, a company reorganisation is in full swing, and users will receive their money back, but not in a single payment and perhaps not in the form it was deposited.

Per the update, under Voyager’s proposed reorganisation plan that was presented on Friday, which is subject to change and requires Court approval, customers will receive a combination of the following, with the ability to select the proportion of cryptocurrency and common equity they receive, subject to certain maximum thresholds:

- Pro-rata share of crypto;

- Pro-rata share of proceeds from the 3AC recovery;

- Pro-rata share of common shares in the newly reorganised Company; and

- Pro-rata share of existing Voyager tokens.

They also added that the plan is subject to change, negotiation with customers, and ultimately a vote. In Voyager’s case, customers are the primary creditors and will have an opportunity to vote on the proposed Plan of Reorganisation. We put together a restructuring plan that would preserve customer assets and provide the best opportunity to maximise value. In addition, the Company is pursuing various strategic alternatives to evaluate the value of the standalone company compared with a third-party investment or sale.

The maximum thresholds have not been disclosed at this time, and the plan is subject to court approval.

According to Cryptoslate, social media feedback has been mixed so far, and a common complaint is that the return of funds should not be on a pro-rata basis.