HASHING IT OUT

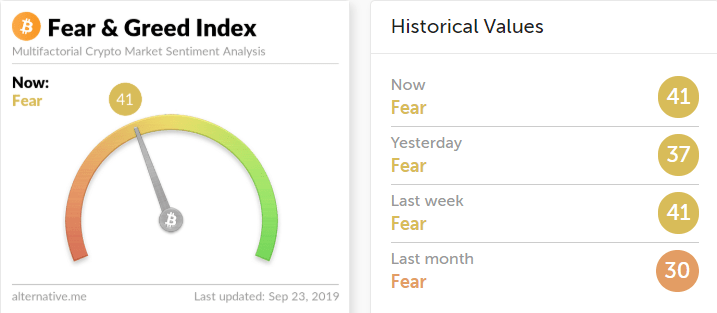

On 18th September, Blockchain.com reported Bitcoin’s network hashrate hit a record-breaking high of 102 quintillion hashes for the first time ever. Canadian crypto researcher and well-known analyst Kevin Rooke commented that, “Difficulty is projected to grow 60% this quarter, and it was already at an all-time high when Q2 ended”.

This increase is a positive sign for the overall security of the blockchain and bodes well for the upcoming Bitcoin halving event next May. If the hashrate is increasing and the block reward is set to halve, then either a large amount of hashrate becomes unprofitable or we can estimate a decent appreciation in price to cover the shortfall in block reward. It might be unrealistic to think a halving event would mean a doubling in the price of Bitcoin to compensate, but I would certainly expect some pressure on supply and demand and an increase in Bitcoin price.

Image Source: Blockchain.com

BAKKT LAUNCHES, ALL A BIT BORING

In the lead up to Bakkt’s launch on the 23rd of September, Chairman of the New York Stock Exchange and Bakkt owner, Jeff Sprecher stated he was nervous about the launch of the platform and he believes it could be months before Wall Street starts to enter the market:

“It’s not demand yet. It’s intense curiosity. It’s the sense that money managers want to be at the front of this train and not left out.”

Dailyhodl reported that Bakkt CEO Kelly Loeffler as saying she expects retail brokers, college endowments and pension funds to be among the first takers:

“The brokers are always looking for an edge to attract new customers and offering Bitcoin could have lots of appeal. [College endowments and pension funds] are the ones who are usually in the forefront in adopting new investment ideas.”

Fast forward 24 hours post launch and initial volume was quite weak, the first hour of trade only saw five total contracts. Then 10 hours later, 28 contracts, 18 hours later around 66 bitcoin contracts, that’s slow going by anyone’s judgement. The slow start could be attributed to it being such a new product and many brokers not being ready to clear through that platform yet. It’s definitely a space to watch and see if the institutional money does start flowing, after all Bakkt is designed to cater to the big money, to give you an idea, they have the exactly the same cyber security systems to the New York Stock Exchange.

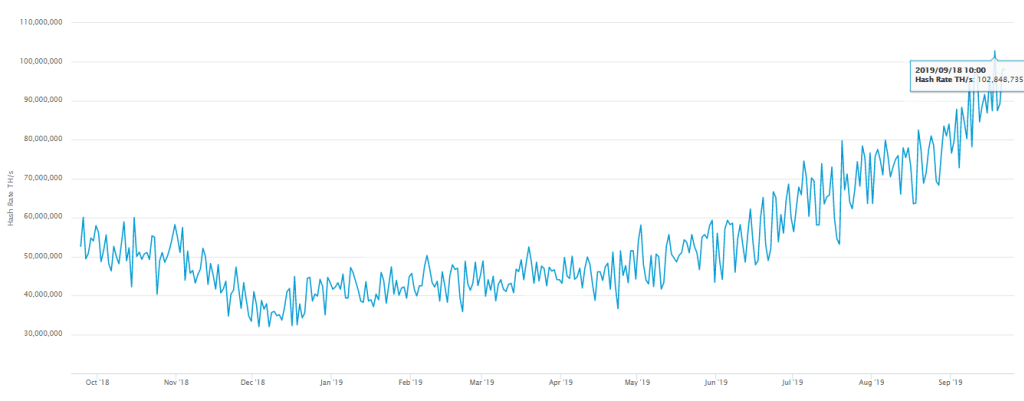

BITCOIN ATM INSTALLATIONS SOAR

Not perturbed by the decline in Bitcoin price from its all-time highs last year, the global rate of ATM installations has been steadily increasing. In fact earlier this week, Micky reported Bitcoin ATM installations are up more than 600% in three years. Recent data shows almost 5,500 machines installed worldwide, up from 755 the same time in 2016.

In the 12 months since 2013 after the first ever Bitcoin ATM was installed in Vancouver, Canada an additional 280 machines were installed across the world and since 2016 that number has nearly doubled every year. They operate pretty much the same as a standard ATM but instead of accessing cash, you access bitcoin with either cash or card.

Hopefully the increased exposure continues at this trajectory and broadens the opportunity for everyone to participate in the next bull run.

FUN FACT

Global ATM numbers currently sit around 3.24 million and are forecast to decline over the coming years. If Bitcoin’s ATMs continue to increase at this trajectory, they could overtake ATMs as we know them by 2029.

STAY SAFE – CYBER RATS ARE ABOUT

Altcoin Buzz reported on a malware virus that has been dubbed the InnfiRAT and acts like a remote access Trojan (RAT). It gets into your system in the usual ways:

- User error – opening email attachments that are infected or untrusted

- Running macros in MS Office infected workbooks

- Visiting malicious websites and clicking on links/downloading files

Make sure you’ve got your safety basics covered; have a rock solid anti-virus system, always be alert when opening emails and visiting or clicking through websites. If you want to be on hyper-alert and really up your security game; keep all of your crypto activities on a separate laptop or PC, and keep as many of your coins in cold/offline storage wallets as possible. Always keep separate passwords for different wallets and platforms.

Once the InnfiRAT makes its way to your machine, it will operate by taking screenshots of you at work… let me specific, photos of your desktop, not via your camera… but then, who knows! It then sends these back to the mothership. It will gain access to your cookies, stored passwords and usernames, and will always be on the hunt for critical information in relation to usernames and passwords. It will specifically search for crypto file names and in folder locations where wallets are usually found. Unfortunately, once infected it will continue to replicate. It’s particularly nasty.

So stay alert, do your research with new links, sites and projects. If you can’t assess whether you are interacting with a trusted/secure site or communication, be smart and do not engage until you’re able to verify.

Tech Times go into more detail if you want to find out more.

BITCOIN INVESTMENT RECOMMENDATION FROM ELON MUSK… OR NOT

In a variation on a theme and following on from the cyber RATs, you should also make sure you are aware of the multiple fake investment vehicles being built around Bitcoin and the promise of good returns. These are usually good traps for new entrants to the space as they can sound pretty realistic and when they are backed by a big name you know and trust, it can be reassuring.

There’s one doing the rounds at the moment with a 4000% ROI and founded by Elon Musk, Richard Branson and Bill Gates. This particular scam is called “Bitcoin Profit” and it’s a pretty poor attempt to be honest with some generic head shots of the founders and near identical investments and returns listed. But for those new to the space or who just don’t really get it at all (sorry mum), it can be pretty alluring.

Some scams are a little more sophisticated. Earlier this year, Aussie celebs Waleed Aly and Karl Stefanovic could be seen on Facebook ads endorsing a Bitcoin algorithm – in fact this was created using facial replication software to make a not terrible video which looked almost authentic. In my social and family circle alone, I was surprised at how many people showed it to me and asked if I thought this was a good opportunity.

Some key things to look out for are authenticity and source. Where are you getting served this content and who is it from? Scammers love to litter their news with bits of truth to give it a more legit feel so you absolutely have to be careful.

Do your research (you might note this is a common theme in these newsletters). If it’s too good to be true, then it probably is. Ask people you trust in the industry if you are still unsure. The Mining Store team is here to help and the community forums are a great place to check your hunches and the legitimacy of the news you are reading.

TECHNICAL ANALYSIS

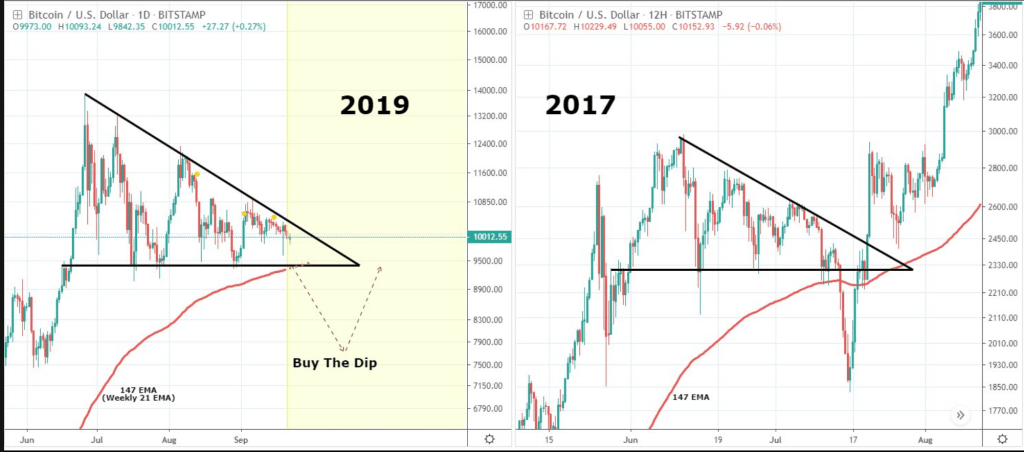

Bakkt Exchange has launched and so far it appears that the launch was a bit of a “non event” for the price of Bitcoin. The hours leading into the launch of the exchange Bitcoin was definitely under pressure hitting all time monthly lows at $9700 USD, however the launch of exchange did not cause a great deal of volatility or volume.

Two major potential scenarios are playing out with BTC at the moment, the descending triangle and the ascending wedge.

The descending triangle is a popular bearish formation similar to what we saw in 2018 when BTC capitulated. If this formation plays out, then based on historical effects there could be an opportunity to buy the dip.

The ascending wedge is also a popular bullish pattern and it could be playing out for Bitcoin. We are coming to the pointy end of this pattern so if it does play out it should be in early October.

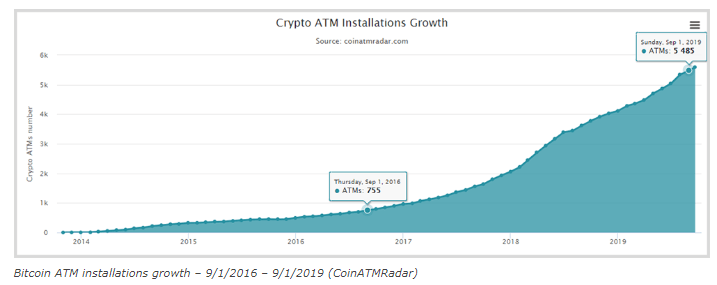

FEAR, GREED AND MENTALITY

The Alternative.me Fear and Greed index has been as boring as counting storks in a field of wheat lately. However, at time of writing Bitcoin has had a few vicious swings below $10K USD and Litecoin dropped from $72USD to $62USD in an hour of trade. The takeout from this is either trade and keep some solid stop losses (if this kind of movement doesn’t worry you) and buy back your initial investment at a 10% discount or you simply stay out of it and leave those hard-earned coins in cold storage.

Don’t get thrown by market movements or boredom. Boredom in markets is often referred to as ‘accumulation’ and is known to be a period where the whales in the space literally bore you into selling your coins to them on violent swings in otherwise flat, sideways markets.

Remember what Warren Buffett said, “The stock market is a device for transferring money from the impatient to the patient.” The same applies to the Crypto markets but on even shorter time frames.