The journey of Cryptocurrency from 2017-2022 and what the future holds

In this article we explore the evolution of cryptocurrency & Blockchain technology from their early mainstream adoption in 2017 to the present day. We look into the roadblocks faced along the way and the milestones achieved. It will be broken down into three parts, with the first part covering the bull run of 2017 and the subsequent crash into 2018 and 2019. The second part deals with the resurgence of cryptocurrency and blockchain through the introduction of deFi and growth of institutional investing across 2020 and 2021. The third part covers 2022 and beyond.

PART 1:

2017: Cryptocurrency-The First Bull Run

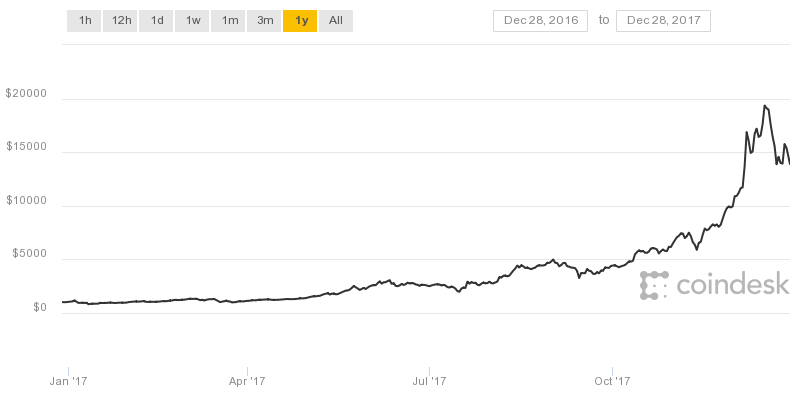

2017 was the year cryptocurrency truly announced itself on the global financial stage. Let’s firstly take a look at BTCs rise. At the beginning of 2017, one Bitcoin was worth around $1,000 USD. By the end of 2017, one Bitcoin was worth around $19,000 USD. What contributed to this meteoric rise? Let’s take a look at some of the major moments for Bitcoin’s price during that 12 month period, a period that exceeded all bullish predictions.

Bitcoin’s surge to stardom

The period of skyrocketing prices in 2017 came between the months of May and September, which saw all-time highs for Bitcoin. We saw the price almost double initially in May, with BTC climbing above $2,000 for the very first time in its history, then subsequently surpassing $3,000 just a few weeks later. So why was this happening? The most noteworthy push came from the entrance of major Wall Street investors and analysts to BTC price watching. Bullish forecasts from analysts such as Goldman Sachs were detailing the vision of BTC surpassing $4,800, with chief technician Sheba Jafari predicting that the price could climb to as much as $4,827 in mid August. This was reinforced by a strong core of analysts from the firm exclaiming “whether or not you believe in the merit of investing in cryptocurrencies, real dollars at work here and warrant watching”. It is a logical consequence that such an affirmation by well-known analysts would have some influence over BTC value.

By the first week of September, BTC surpassed $5,000. However, this is where investors, for the first time in a few months saw a true correction to the market, with BTC then falling below $3,000 in mid September. Yet it returned to an all-time high of $19,000 in mid December. This was despite the closure of major Chinese exchanges and a global regulatory crackdown starting to take shape.

2017 was the year that cryptocurrencies such as BTC began to be taken seriously amongst regulators and investors, despite not being entirely able to directly compete yet with traditional finance intermediaries. There was general excitement amongst global investors, causing an upward trajectory based on bullish sentiment, as Bitcoin was starting to be adopted as a payment, and was able to be processed through international money transfers. We saw the introduction of derivative exchanges, private index funds, public funds, an array of hedge funds, proposals for ETFs, and institutional offerings by cryptocurrency exchanges, all off the back of BTC becoming a real asset in the eyes of institutional investors. There was also a massive element of FOMO (fear of missing out), with an insane rush of retail investors flocking to purchase BTC and associated cryptocurrencies to ensure they didn’t miss out on the craze, escalating prices due to expanded demand globally. This led to the first period in cryptocurrency where thousands of individuals globally were able to cash in on the bull run, experienced or inexperienced, making hundreds upon thousands of dollars.

XRP’s incredible run

With this rapid rise of BTC, what else happened in 2017 for cryptocurrency? Surprisingly, BTC was not the best performing established cryptocurrency throughout that boom despite its value growing by over 1,000%. Bitcoin was able to pave the way for cryptocurrencies such as the infamous Ripple (XRP) to grow as much as 36,000% throughout 2017, reaching as high as $2.28 towards the end of December, and a market capitalisation of roughly $90 billion. Ripple grew extensively in popularity with its technology facilitating open-source payment system which was designed to provide an enterprise-initiated blockchain and cryptocurrency in order to draw the attention of businesses and banks. Its incredible 2017 rise can be attributed to the signing up of several financial institutions to its blockchain network, with clientele growing to over 100.

Ethereum’s rise as the go-to decentralised platform

Ethereum, as a leading blockchain technology, provided for numerous, successful ICO launches throughout 2017. Ethereum was able to provide a platform for decentralised, industry-wide applications, such as the introduction of CryptoKitties, a blockchain game that popularised non-fungible tokens. Furthermore, it is said that it established over 250 ERC20-based projects, with over 500 more between concept and demo phases. Ethereum rose by over 9,000% in 2017, growing from around $8 at the beginning of January, to as high as $750 in late December, and a market cap of $73 billion.

The bleak ending to 2017 and subsequent start to 2018

After such euphoric highs for BTC and its fellow cryptocurrencies, on December 27th the Bitcoin market came crashing down as investors took profits, harvesting gains from what was an obvious bubble ready to explode. The Bitcoin price crashed below $12,000 after reaching as high as $19,000 in mid December. Most cryptocurrencies were reaching highs in early January 2018, until a devastating market-wide crash, following BTCs fall. By the 14th of January, 2018, BTC had already dipped a further 15% from the prior week, with XRP falling a whopping 43% over that 7-day period. Ethereum was able to improve its position by as much as 16%, until a week later losing 22% over a week and roughly $30 billion in market cap. The state of the top 10 cryptocurrencies on the 21st of January, 2018, was captured in the following headline:

2018: The Great Crypto Crash and Subsequent Winter

The Crash of 2018

What ensued in 2018 was the beginning of the multi-year bear market. By the start of February, BTC was down to roughly $8,000, ETH at $830 odd, and XRP as low as $0.80. By the 1st of April, BTC was at $6,800, ETH at $380 and XRP at $0.48. Dubbed the “crypto winter”, roughly $700 billion was wiped off the cryptocurrency market capitalisation after the markets hit an all-time high at the end of November 2017, according to data from coinmarketcap.com. Then, by the end of December, BTC had dived to around $3,800, ETH was down to a staggering $130 with XRP still floating around at $0.35.

Why did it crash?

Much of 2018’s bear market can be attributed to market manipulation, regulatory crackdowns, different types of prohibitions, AML, and KYC. These factors caused low volume in the cryptocurrency markets for most of 2018.

Regulatory uncertainty was most definitely one of the leading causes of the crash. In 2017, China began to clamp down on cryptocurrency, banning certain cryptocurrency exchanges and ICOs, as well as in 2018 clamping down on Bitcoin mining operations.

Furthermore, Wall Street regulators and other various US financial authorities began to investigate multiple entities for cryptocurrency trading throughout 2018, claiming that they were announcing a “series of actions, including levying fines, against companies involved with cryptocurrencies”. Additionally, Swiss businesses began to feel the heat, with heavy regulation of those companies involved in cryptocurrency leading to the point where they started looking to move to more crypto-friendly countries. This is even after Switzerland had been coined the “Crypto Valley”, home of the ICO.

The crash was also fuelled by the introduction of CFD and leverage shorting being made available. As BTC and the cryptocurrency markets subsequently started to crash, investors were left scrambling to cover their margins and leverage, having to sell off more and more assets, including their cryptocurrencies, in order to raise cash to cover their debts.

On top of this, many exchange hacks were occurring throughout the infant years of cryptocurrency, including in January 2018, when the Japanese exchange Coincheck was hacked for $543 million. According to the head of Asian trading for the foreign exchange Oanda, Stephen Innes, hacks were the first element to negatively affect cryptocurrencies, which was seen with Coincheck’s disclosed hack, happening right around the time of Bitcoin’s peak, and this certainly seemed to accelerate its drop.

The element of FOMO only compounded the bubble. More and more retail investors sought to jump in on the latest craze that was BTC & cryptocurrency, with Coinbase, one of the world’s largest cryptocurrency exchanges, signing up to 50,000 or more new customers a day during 2017’s bull run. This included many companies pivoting their way towards blockchain for no apparent reason other than it seemed like a way to create buzz and hype around their products. Blockchain technology at this point in time was still young and yet to be fully developed. Eventually this caused many retail investors to buy at the top, then market manipulators with large holdings selling off most cryptocurrencies, proving that at that point in time, cryptocurrency was a massive, speculative bubble.

Despite the Bear Market, what were the positives?

Irrespective of the crash, there were some positives to take out of 2018. Cryptocurrencies worldwide were beginning to be accepted as a medium of exchange, or form of donation. Over 75% of blockchain initiatives in philanthropy were being used to facilitate payments, to ensure the effective transfer of money with great transparency and faster transactions (up to 10% of funds can be lost in transaction fees or fluctuating exchange rates).

We also saw charities such as Australian-based Charitex, and more notably, the largest provider of donations and the US’s second largest grant maker behind Bill Gates’ foundation, Fidelity Charitable, begin to accept cryptocurrencies as a form of donation. Reports suggest that Fidelity received up to $69 million in cryptocurrency donations, representing a 1000% increase from the previous year.

With the rise of Ethereum as a blockchain technology, the development and utilisation of smart contracts was beginning to increase. Being one of the most fascinating developments of blockchain technology, smart contracts are unique in the way they can facilitate guidelines and agreements automatically without the need of a third party. Even for small businesses, automation can make business transactions and negotiations far more efficient. For instance, “escrow” is a service worth billions of dollars in which a legal arrangement is in place whereby a third party will temporarily hold large sums of money or property until a particular condition has been met. Real estate escrow services, for example, charge as much as 1-2% of the value of a property to hold onto purchase funds until a deal’s conditions have been met. Those types of services were beginning to tap into smart contracts, offering increased transparency and security while simultaneously speeding up the whole process.

Proof-of-work vs Proof-of-stake debate

Following on from Ethereum’s strong developments, it’s important to note that despite 2018 experiencing a crash and subsequent bear market, it was still perhaps the greatest year for blockchain technology advancements. Ethereum, amongst other cryptocurrencies, started to experience major scalability issues which led to a divide between “proof-of-work vs proof-of-stake consensus”.

To explain, progress in both the scalability and efficiency of blockchain technology relies on the speed and security of the consensus algorithms utilised. The main difference between the two consensus mechanisms is what determines the distribution of blocks and rewards. Proof-of-work’s distribution is centred around the computational power utilised, whereas proof-of-stake is centred around the amount of currency staked. As proof-of-work lacks sufficient efficiency with only 13 transactions per second being handled, those networks that have smart contracts in place require a mechanism that can handle whole enterprise loads. Moreover, having proof-of-stake in place would allow for both lower and more negligible transaction fees. A platform like Ethereum with proof-of-work in place currently has insanely high gas fees.

As the constant comparisons between the two algorithms began to heat up, the dynamic of decentralised finance and the market began to substantially shift, introducing investing means such as staking, whereby investors could earn yields for locking up their currencies (staking). This became much more popular in 2020 and 2021.

Improved Regulation

A key indicator of the market fall, regulation – was receiving more attention from lawmakers. As blockchain technology was being popularised, it was beginning to create large sums of money for individuals and entities, thus governments were increasing their intense scrutiny. We began to see entities such as the ATO begin to properly regulate those individuals making income on their disposals of cryptocurrencies as assets, enforcing CGT rules.

Also, since 2018, digital currencies have been caught by Australia’s anti-money laundering and counter-terrorism financing regime. According to Global Legal Insights, these amendments “recognised the movement towards digital currencies becoming a popular method of paying for goods and services and transferring value in the Australian economy and addressed the possibility of digital currencies being used for money laundering and terrorism financing”. As mentioned, although being a cause of market dips, regulation is not necessarily a bad thing for blockchain technology, as regulation may help improve consumer trust, whilst also providing a further framework for security, which is needed for further growth.

2019: The Bounce Back and Introduction of Decentralised Finance

The beginning of 2019 was very much an extension of 2018. Bitcoin was priced between $3,840 and $4,150 between January to April, with ETH being between $140 and $141, and XRP being between $0.36 and $0.31.

The reason for a lack of growth was mainly due to the same issues previously outlined in 2018. Following on from the numerous exchange hacks in the infancy years on cryptocurrency, in 2019 we continued to see further exchanges have security breaches. New Zealand based Cyptopia was hacked for over $16 million in the first few weeks of January, followed by a further 13 hacks of major cryptocurrency exchanges that resulted in losses close to $300 million dollars and over 500,000 user logins. This equates to over one hack a month.

Less institutional investment caused weaker sentiment

Due to the direction of the market in 2018, in 2019 there was far less money being invested into the cryptocurrency market. With weaker sentiment from institutional investors, the cryptocurrency world saw cryptocurrency-focused funds be slashed in half from 2018 to 2019, with 2018 producing 284, and 2019 producing 128 funds.

Additionally, with the explosion of ICOs in 2017, 2019 saw a lot less money allocated to private funding rounds and ICOs. According to a report from Crunchbase, only $3.38 billion was allocated to ICOs and private-funding rounds across 472 deals in 2019, compared to 2018’s $12.86 billion spread across 1331 deals. This was a major factor in weakened sentiment from institutional investors.

However, there was a period throughout 2019 in which the cryptocurrency market looked promising. From April onwards, BTC started to rise in price. By the 25th of June, BTC had seen a 29% rise in price, jumping all the way up to $11,790, meaning it had almost tripled from prior months, before falling between the $7,000 to $10,000 range for the subsequent months until December. Similarly, ETH on the same date saw a 20% increase in price, sitting at $318 per ETH. It hovered roughly between $300 and $150 throughout the subsequent months until December.

With this positivity, regulation in blockchain technology continued to make major steps

Following on from regulation improvements in 2018, 2019 saw a number of regulatory developments with lawmakers and governments pushing for a more mature regulatory environment. We saw countries like China introduce legislation to parliament, which was subsequently approved and was effective from Jan 1, 2020. This was, for cryptography law, designed for “regulating the utilisation and management of cryptography, facilitating the development of the cryptography business and ensuring the security of cyberspace and information”. As a result, the Chinese government went on to develop its own central bank digital currency (CBDC), while cracking down on other digital currency activity. Seemingly, China was benefiting from blockchain technology, however avoiding other associated problems like illegal use of cryptocurrencies and speculation.

In the US, we also saw regulatory crackdowns on token sale issuers. The SEC was able to settle with Block.One, the creator of EOS, after they raised more than $4 billion. Apparently EOS underwent an ICO, without registering the token sale as a securities offering, and without attempting to obtain an exemption from federal security laws. They ended up paying a $24 million fine with BTC’s price burst into activity once again.

Additionally, the SEC also ended up suing Telegram, who raised $1.7 billion by selling TON tokens, as well as Kik and other entities that raised funds via dodgy ICOs. These movements in the US were paving the way for further regulatory development in various jurisdictions, particularly developing nations, making a step in the right direction in reaching a consensus on the status of digital assets and guidelines governing the trading, usage and taxation on cryptocurrencies.

International brands and the cryptocurrency space

In 2019, despite the figures showing a major downfall in institutional investing, cryptocurrency also saw some major international brands dip their toes into blockchain technology.

Samsung, one of the world’s largest producers of electronic devices, sought to become a major contender in blockchain software development. In 2019, they presented their own “blockchain software development kit”, that could offer blockchain solutions, both to other businesses and to consumers. They already had in place a wallet for naive cryptocurrency on the Galaxy S10 smartphone.

Nike in 2019 also submitted a patent application to produce a new range of Nike sneakers to the Ethereum blockchain. What this shows is that, in 2019, everyday products were slowly, but surely linking up with blockchain technology. This extended to Ikea, who made its first payment in 2019 using a blockchain, marking a major development in the adoption of blockchain technology in making payments globally through recognised multinational companies.

Growth of Ethereum & decentralised finance

It’s also important to note that in 2019, Ethereum continued to grow successfully. Throughout 2019, it continued to lay the foundations for a completely new economy, that is, decentralised finance (deFi). Building on its 2018 momentum, Ethereum’s ecosystem improved astonishingly , with four times as many active developers as any other project. Ethereum had 25 new decentralised organisations in place, 4 million new active addresses and 500 new dApps created on the blockchain, continuing to build DeFi into 2020.

Decentralised finance is the elimination of central intermediaries such as banks, allowing individuals and entities to conduct financial transactions through emerging technology without the need of a third party. DeFi utilises blockchain technology, a distributed ledger, in order to collect and aggregate all data from all users and uses consensus in order to verify. In 2019, applications, frameworks and protocols such as MakerDAO, Uniswap, Dharma and Compound (as well as others), appeared in the cryptocurrency scene and are now building integral foundations for the future of a decentralised finance system.

By the new year, off the back of these developments, BTC had reached a stable price of $7,200, ETH was around $130 and XRP was at $0.20.