TRUMP TWEETS

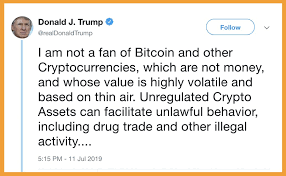

Last week, bitcoin and cryptocurrency were thrust into the Twittersphere spotlight once again but this time thanks to Donald Trump who tweeted the below from his personal account. This is the first time a sitting American President has referenced publicly or even acknowledged cryptocurrency. It seems the news of Libra has unsettled the President as this came just about a month after Libra’s whitepaper release.

Just after these tweets came out, the Bitcoin price did start the slide down from its trading range of $12k USD.

FEAR & GREED

Yesterday saw the index drop to a low of 19, this is incredibly worrying and reflected in Bitcoin’s price weakness, falling from $12K USD to $9K over the last week. If you were tracking this index it would have been a good time to buy up some bitcoin. As always, these indicators are just one tool, and you could have easily been a buyer at $10K and seen the price drop to $9K. You really need to keep your emotion in check if you’re going to seriously trade bitcoin, but these wild swings do present amazing opportunities. Since the $9K low Bitcoin has surged back to $10.6k and even jumping $1,000 in 30 minutes at one stage, it is looking like the sellers are exhausted… for now.

FACEBOOK, LIBRA, ZUCKBUCKS AND A CONGRESS GRILLING

With this week’s U.S. governmental hearings on Facebook’s Libra cryptocurrency, unsurprisingly Bitcoin volatility (and digital currency in general) has been a bit of a recurring theme and the initial congressional fact finding sittings with Calibra and Libra’s team, congress pounded Calibra’s head, David Marcus with questions of sustainability, privacy and intentions. Being the former head of Facebook Messenger, PayPal and Coinbase, Marcus was more than well-equipped to respond.

The mood in Congress was one of uncertainty, and while they continually cite their eagerness to promote innovation and progressiveness there are obvious undertones of concern around Facebook’s previous data breaches and Cambridge Analytica.

Maxine Waters, chairwoman of the congress, opened proceedings, citing the general concern in the room about a large corporation having sway over fiscal system and systemic risk:

- “They are trying to create a global currency and ecosystem, If Facebook holds government assets in a Libra trust they could transfer the government influence into the hands of a few elites, ultimately if Facebooks plans come to fruition the company and its partners will yield immense economic power that could destabilise currency and governments.”

Calibra’s David Marcus opening statement was heavily focused on the remittance side of the project and he made specific reference trying to distance the project from Facebook’s direct control by claiming that Facebook would only have one vote out of 200 members and Calibra would be a completely separate company and entity. Mr Marcus also touched on the decision to use Switzerland as the base for Calibra and Libra due to it being, “…the center of global banking”. He continued, “…we would like Libra to be a global currency, one unit of digital currency for the whole world and this is why we believe this was the right approach”

Mr Marcus specifically addressed the concern amongst Congress that Calibra would be out of America’s control if all assets and custodial services were going to be held in Switzerland, emphasising that this decision was not to keep it out of reach but to ensure the services could be used globally and would not bound by local restrictions.

North Carolina Congressman, Mr Patrick McHenry, made for a refreshing change of mood and shared some more progressive views during his question time when he said, “The reality is, whether Facebook is involved or not, change is here. Digital currencies exist, blockchain technology is real, and Facebook’s entry in this new world is just confirmation, albeit at scale. He went on further,

- “…The world that Satoshi Nakamoto, author of the bitcoin whitepaper, envisaged and others are building is an unstoppable force. We should not attempt to deter this innovation and governments cannot stop this innovation, and those that have tried have already failed … we want to try and understand it, and understand if our current regulatory framework meets the demands of this new technology”.

Arkansas Representative, Mr French Hill asked, “…average global cost of remittances is about 7%, so tell me what fees you will be charging for moving money inside the Calibra system?”

Marcus’ response was that the initial platform will strive for fees next to nil… to begin with but that there would probably be small and very competitive merchant fees. He also highlighted that the Calibra platform will not seek any form of advertising income, “… (there will be) no advertising in the Calibra wallet. The Calibra revenue stream will likely be by offering a range of financial services with existing financial institutions and banks” but this won’t be until later down the development roadmap, about 3+ years.

On security and money laundering side of things:

Marcus’ states “both sides of the accounts will need KYC” in reference to what restrictions will be imposed on just anyone opening a Calibra wallet. KYC refers to Know Your Customer and is designed to prevent fraud, money laundering and illicit activities globally for all money transmitters/remitters.

On scaling the Calibra network Mr Gregory Meeks Congressman:

If Calibra captured “Even 10% of its current Facebook user base to the Libra wallet, do you understand that would absolutely make you a systemically risky financial institution… and we would designate you as such”. Mr Meeks was eluding to imposing the similar designations as they would usually for a bank, and in reference to the global Facebook user base of around 2.6 Billion, making 10% around 260 million people, to put it into perspective PayPal last reported 277 Million users, and they are already operating in a very similar capacity and space with none of the licences Meeks is referring to. Making it explicitly clear, Marcus responded with “…we will not be a bank” and likened Calibra to already operating competitors such as PayPal and WePay.

Mr Bill Huizenga Congressman for Michigan’s 2nd district had concerns around Libra wanting to be a regulated cryptocurrency, his concern was that by definition most cryptocurrencies strive to be decentralised and this is where they add the majority of value to there users, so he “Are you able to maintain the core of a cryptocurrency if you are under all this regulation?” Meaning that if we do successfully regulate you, wont you lose the essence of what you are trying to achieve – decentralisation. It does pose the question more broadly, how decentralised will Libra actually be?

Marcus’ response, “we believe we can, congressman, in order for any form of digital currency and payment system to reach mass adoption it needs to be regulated”. It was a fair point and what other major players in the cryptocurrency, such as Gemini and the Winklevoss twins have been working towards for years.

Congressman Jim Himes had concerns around foreign exchange risk, meaning the USD, GBP etc being held to underpin the value of Libra were to devalue over time, then wouldn’t that devalue Libra itself. He led this line of thought into pursuing the question that if Libra merely represented a group of stable assets then “why is this not an exchange traded fund (ETF)”, the SEC says “if you have a security that is backed by other securities you’re an exchange traded fund”. The risk here is if Libra is recognised as an ETF it would need to comply with a plethora of investment standards and regulations.

Marcus was confident that while Libra “uses some operational mechanisms that are similar, we believe that it is not because Libra is a payment tool … we believe no one will buy Libra as an investment as it is designed for stability. That’s number 1. Number 2 uses the idea that you invest in the product based on the management of the product as an investment”.

Marcus cited that general use case for its customers will be to remit money at low rates and a stable rate within the U.S. and globally. Not as an investment tool to hold over a long period and see investment returns.

Congressman Brad Sherman saw the topic as “one of the biggest issues this panel will deal with in decades”. However his outlook was somewhat unrealistic and referenced what impact Osama Bin Laden and the September 11 tragedy had on America and went on to state that Calibra “…may do more to America than even that”. It is concerning to hear Congress referencing terror attacks in the same sentence as an international remittance system, Sherman was quite explicit that “America’s power comes from the power of the dollar, more, I think, than the power of our military”.

Congresswoman Alexandria Ocasio-Cortez raised the same concerns as many that Calibra could be “…controlled by a undemocratically selected coalition of largely massive corporations” and that this should be seen as a concern by all. Imagine a global currency that was used by the masses but controlled by the few elite, this is the very essence of what Bitcoin has been trying to avoid and speaks volume for the concern of what Libra is perhaps trying to create.

While it was a heated session at times, the overall feeling was that many in Congress welcomed the technology advancements that Calibra and Libra can bring to the US and in fact globally for unbanked people. But congress seems to be really struggling to define where Libra and, digital currency in general, fits in the existing frameworks of archaic banking legislation and the never-ending fight against cyber crime. The discussions continue, but it’s fair to stay Calibra and Libra seem here to stay and are striving to be 100% compliant before launch. Just who will or won’t benefit and the final framework remains to be seen but based on this week’s price action, it seems whatever happens, Facebook’s foray into crypto will inevitably impact bitcoin’s price in both the short and long term.

COLLOQUIALLY, SHITCOIN

If you need a little lift after all that dense congress business, check out “Colloquially, Shitcoin” it’s pretty weird to hear the word “shitcoin” thrown around Congress. My take is that Libra is probably copping it as the shit coin here but I’ll let you decide.

The below infographic gives you a good idea of how bitcoin has held up compared to altcoins from all-time highs:

BTC WEEKLY PRICE UPDATE

BTC had a major pull back this week and traders were watching the 10k USD support line like hawks. BTC did briefly break the 10k USD support line, however it appeared there were plenty of campers happy to pick up BTC between the 9-10k USD mark and sure enough BTC returned straight back above 10k USD. BTC also shot above the 50 day moving average line which signals bullish territory and confirms the continuation of an upward trend.

HILARIOUS REMIX & KEEPING UP WITH THE TWEETS

On a far lighter note.. this week I’ve spotted some brilliant memes and videos – the bitcoin version of Old Town Road by @TheCryptoBubble is most excellent and well worth 3 mins of your time.

Author: Julian Carruthers

Not financial or investment advice, always do your own research.